When it comes to investing, selecting the right brokerage can make all the difference. Two of the biggest names in the game are Vanguard and Fidelity. While both offer similar investment options, there are significant differences in their investment strategies, fee structures, and tools for investors. In this article, we will compare Vanguard and Fidelity to help you make an informed decision when choosing between the two.

Examining the Investment Differences: Vanguard vs Fidelity

- Explain the difference in investment philosophy between vanguard and fidelity

- Vanguard’s passive approach to investing, with a focus on low-cost index funds

- Fidelity’s active approach, utilizing both mutual funds and actively managed portfolios

Vanguard and Fidelity have different investment philosophies. Vanguard is known for its passive approach of building diversified portfolios with low-cost index funds. They believe in staying invested in the market over the long term and focus on generating returns that match the overall market. On the other hand, Fidelity follows an active approach and seeks to generate higher returns than the market by investing in individual stocks and actively managed portfolios. While both approaches have their pros and cons, it’s important to consider your personal investment goals and risk tolerance when choosing between vanguard vs fidelity.

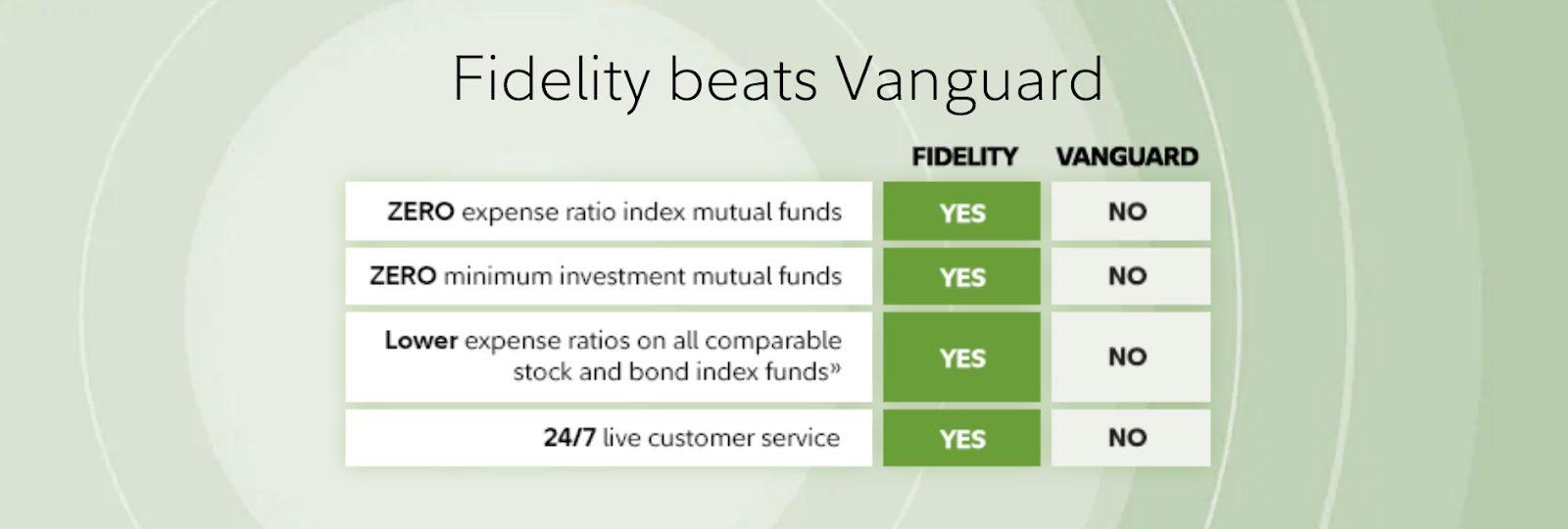

IMG Source: tokenist.com

What are the pros and cons of passive vs active investment strategies?

Passive investment has lower fees and is less risky, but it may underperform compared to actively managed investments which have higher fees but offer potentially higher returns.

The Fees and Expense Ratios of Vanguard vs Fidelity.

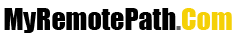

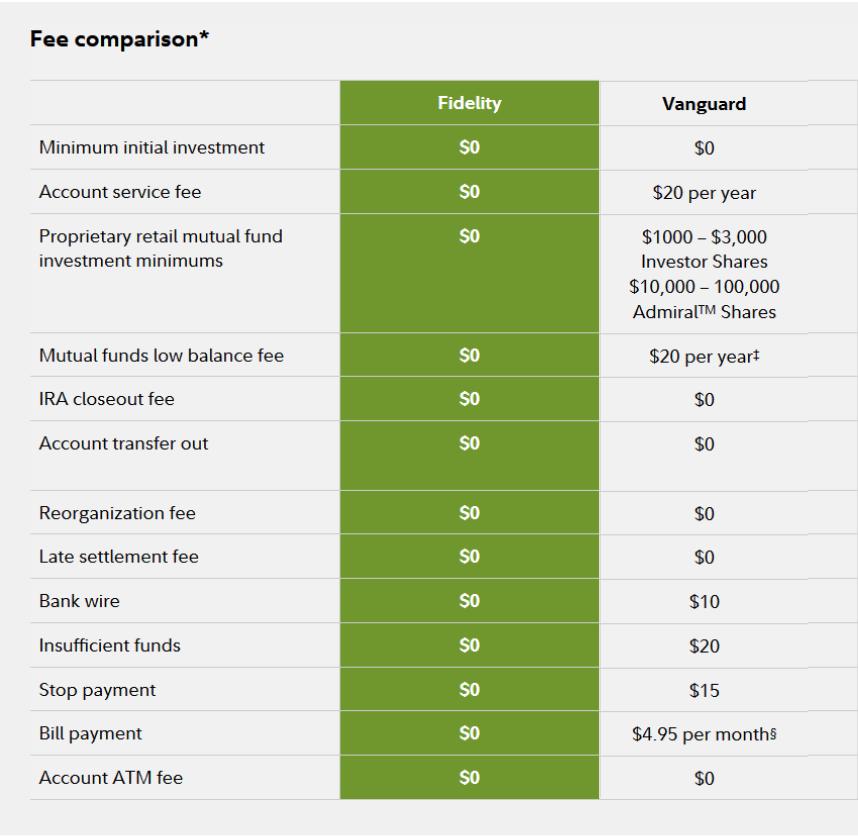

Fees and expense ratios are a crucial consideration when choosing between vanguard vs fidelity. Lower fees and expense ratios can make a significant difference in the overall performance of an investment portfolio. Vanguard is known for being a low-cost leader, with fees that are often significantly lower than those of competitors, including Fidelity.

Here’s a table comparing the expense ratios of some popular index funds offered by both companies:

| Index Fund | Vanguard Expense Ratio | Fidelity Expense Ratio |

|---|---|---|

| Vanguard S&P 500 Index Fund | 0.09% | 0.09% |

| Vanguard Total Stock Market Index Fund | 0.14% | 0.09% |

| Vanguard Total Bond Market Index Fund | 0.15% | 0.15% |

| Fidelity 500 Index Fund | N/A | 0.09% |

| Fidelity Total Market Index Fund | N/A | 0.09% |

| Fidelity U.S. Bond Index Fund | N/A | 0.05% |

Keep in mind that expense ratios aren’t the only fees to consider when investing, and other costs, such as transaction fees and account fees, can also add up over time.

IMG Source: mymoneywizard.com

What other fees besides expense ratios should I consider when choosing between Vanguard and Fidelity?

Other fees to consider when choosing between Vanguard and Fidelity include transaction fees, account maintenance fees, and fees for certain services or products.

Investment Options: A Comparison of Vanguard vs Fidelity

When it comes to investment options, both vanguard and fidelity offer a wide range of choices to suit different investing goals and styles. Here are some of the options investors can expect:

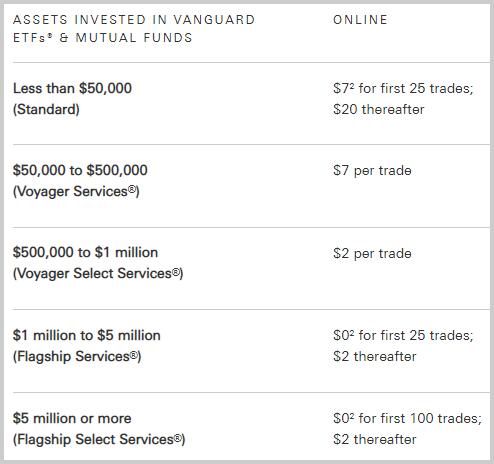

– Mutual funds: Both vanguard and fidelity offer a selection of mutual funds, including index funds and actively managed funds. Vanguard specializes in index funds, while Fidelity offers a greater selection of active funds.

– ETFs: Exchange-traded funds (ETFs) are a popular option for investors looking for diversification and flexibility. Both vanguard and fidelity offer a range of ETFs with competitive expense ratios. Investors can check out Vanguard ETFs performance and Fidelity ETFs selection for more information.

– Bonds: For investors looking for fixed income, vanguard and fidelity offer a variety of bond funds with different durations and risk profiles.

– Individual stocks: Both vanguard and fidelity allow investors to trade individual stocks, although this may not be the best option for everyone.

When comparing the selection and performance of mutual funds between vanguard vs fidelity, it’s important to consider factors such as expense ratios, past performance, and investment holdings. Both companies offer a mix of quality mutual funds, so it’s important for investors to do their research and choose funds that align with their investment goals and strategy. Experts recommend investors to check out Vanguard mutual funds performance and Fidelity mutual funds selection to get a better understanding of their options.

IMG Source: cxoadvisory.com

What should investors consider when comparing mutual fund options between Vanguard and Fidelity?

When comparing mutual fund options between Vanguard and Fidelity, investors should consider the fees and expenses associated with each option, the investment objectives and strategies of the funds, the performance history of the funds, and the quality of customer service provided by each company.

Fidelity vs Vanguard: Tools, Resources, and Standout Features

Both vanguard and fidelity offer a variety of tools and resources to help investors make informed decisions. Here are some examples:

– Educational resources: Both companies provide educational content such as articles, webinars, and videos to help investors learn about investing and personal finance.

– Portfolio analysis tools: Vanguard and Fidelity offer portfolio analysis tools that can help investors track and analyze their investments, estimate future returns, and identify areas for improvement.

– Retirement planning tools: Vanguard’s retirement planning tools are highly regarded for their user-friendliness and accuracy, while Fidelity has a variety of retirement calculators and planning resources to help investors plan for the future.

– Robo-advisors: Vanguard and Fidelity both offer robo-advisors (Vanguard Personal Advisor Services and Fidelity Go, respectively) that use algorithms to automate investment decisions and create personalized portfolios.

When comparing the quality and usefulness of these resources, it may come down to personal preference and investing style. Some investors may appreciate Vanguard’s straightforward and educational approach, while others may prefer Fidelity’s more hands-on and customizable tools. Additionally, one company may have standout features that give it an edge over the other, such as Vanguard’s low-cost index funds or Fidelity’s active portfolio management. Ultimately, it’s up to investors to decide which tools and resources align with their investing goals and preferences.

IMG Source: listenmoneymatters.com

What are the differences between Vanguard and Fidelity’s investing tools and resources?

There are several differences between Vanguard and Fidelity’s investing tools and resources. Vanguard offers a focused range of low-cost investment options with a long-term investment philosophy, while Fidelity provides a broader range of investment options, including more actively managed funds. Additionally, Vanguard’s website has a more simplistic design compared to Fidelity’s website, which has more advanced research and analysis tools.

Customer Service Comparison: Vanguard vs Fidelity

When it comes to investing, having access to quality customer service and support can be crucial. Here’s how Vanguard and Fidelity compare:

– Phone support: Both Vanguard and Fidelity offer phone support during regular business hours, with additional support available for higher-tier clients.

– Live chat: Fidelity offers live chat support for all customers, while Vanguard’s live chat feature is limited to just a few hours per day.

– Email support: Vanguard and Fidelity both offer email support, with response times typically within 24-48 hours.

– In-person support: While both companies have physical branches throughout the country, Fidelity has a larger network of branches and may be more convenient for some investors.

In terms of the level of customer service offered, both Vanguard and Fidelity are highly rated by customers and industry experts. However, there may be notable differences in support options or response times that could sway investors one way or the other. It’s also worth noting that both companies have robust online resources and tools (such as account management and trading platforms) that may reduce the need for frequent customer support interactions.

IMG Source: yimg.com

What are the differences in customer support options between Vanguard and Fidelity?

The customer support options between Vanguard and Fidelity differ in terms of availability, support channels, and types of assistance offered.

Conclusion

In conclusion, choosing between Vanguard and Fidelity ultimately comes down to an investor’s personal preferences and investment goals. Both companies have strengths and weaknesses in different areas, and it’s important for investors to carefully consider these factors before making a decision. Here are a few key points to keep in mind:

– Vanguard is known for its low-cost index funds and passive investment strategy, which may be more appealing to long-term, risk-averse investors.

– Fidelity offers a wider range of investment options (including active funds and individual stocks) and has a more robust customer support network.

– Both companies offer a variety of tools and resources to help investors make informed decisions, including online platforms, educational materials, and financial planning services.

– Fees and expense ratios are an important consideration when choosing between Vanguard and Fidelity, and both companies have competitive offerings.

Ultimately, investors should do their own research and carefully consider their own goals and preferences before making a decision. Whether you choose Vanguard or Fidelity (or another investment firm altogether), the most important thing is to stay focused on your investment strategy and remain disciplined in your approach.