A mortgage is a loan that is used to purchase a property. Mortgages are an essential component of real estate trades, as they allow buyers to finance their purchases over an extended period. There are several types of mortgages available to buyers, including fixed-rate mortgages, adjustable-rate mortgages, and government-insured mortgages. In a mortgage, the borrower takes out a loan from the lender and agrees to repay it over time. The lender provides funding and charges interest on the principal amount borrowed. The borrower is responsible for making monthly payments, which consist of principal and interest. Factors that determine mortgage payments include the amount borrowed, interest rate, loan term, and down payment.

Mortgages: How They Work and Who’s Involved

- Explanation of how mortgages operate

- The role of lenders and borrowers in a mortgage

- Factors that determine mortgage payments

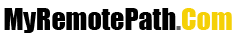

In a mortgage, the borrower takes out a loan from the lender and agrees to repay it over time. The lender provides funding and charges interest on the principal amount borrowed. The borrower is responsible for making monthly payments, which consist of principal and interest. Factors that determine mortgage payments include the amount borrowed, interest rate, loan term, and down payment.

IMG Source: wallstreetmojo.com

What is the difference between principal and interest in a mortgage payment?

The principal is the amount borrowed for a mortgage, while interest is the fee charged by the lender for borrowing the money.

Benefits of Mortgages

One of the primary benefits of having a mortgage is that it allows individuals to own a home without requiring them to pay the full purchase amount upfront. Through regular payments, a homeowner builds equity in their property, which can be used to access cash or sell the home for a profit. Additionally, homeowners can deduct their mortgage interest payments on their taxes. According to recent studies, the homeownership rate in the US has increased to 65.6%, the highest since 2014.

| Advantages of Mortgages | Risks of Mortgages |

|---|---|

| Allows homeownership without full payment upfront | Default may lead to foreclosure |

| Builds equity in property | Default can damage credit score |

| Tax benefits through mortgage interest deduction | Unexpected events can lead to default |

IMG Source: investopedia.com

What is the current homeownership rate in the US?

The current homeownership rate in the US is 64.2%.

Risks of Mortgages

While mortgages offer many benefits, they also carry risks. Any default, i.e., failure to make payments, can result in foreclosure, where the lender seizes the property. This can have negative consequences for both the borrower and lender, damaging credit scores and resulting in significant financial losses. According to data from the Mortgage Bankers Association, mortgage delinquency rates dropped to 5.9% in the fourth quarter of 2020, the lowest since the first quarter of the year. To mitigate risks, borrowers should thoroughly plan their finances and consider their ability to make mortgage payments before taking out a mortgage.

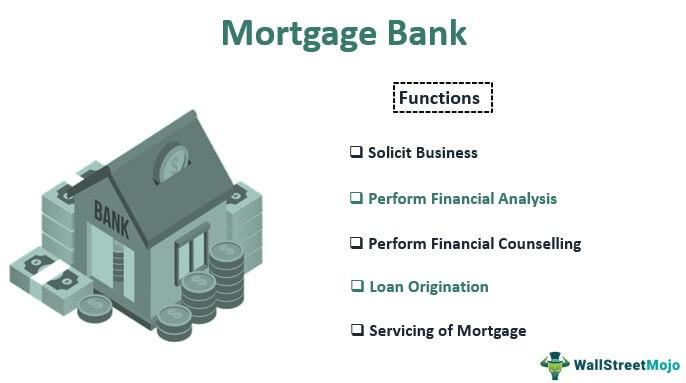

IMG Source: financestrategists.com

What are some ways to mitigate the risks associated with taking out a mortgage?

Some ways to mitigate the risks associated with taking out a mortgage include having a substantial down payment, maintaining a good credit score, choosing a fixed-rate mortgage, considering mortgage insurance, and having an emergency fund.

Despite the risks, mortgages remain a popular way for individuals to purchase homes. In fact, the majority of homebuyers opt for mortgages to finance their purchases. A mortgage can be a smart financial decision for those who plan ahead and budget appropriately. It provides a pathway to homeownership that may not otherwise be possible. However, a mortgage is a significant, long-term commitment, which should be carefully considered before signing on the dotted line.

Ultimately, whether or not to take out a mortgage depends on an individual’s financial situation, goals, and priorities. It is crucial to weigh the benefits and risks, and to consider all factors carefully. While a mortgage can allow for a significant investment, it can also result in significant debt and risk if not handled properly. Individuals who are considering taking out a mortgage should thoroughly research lenders and loan options, and consult with a financial advisor or real estate professional if necessary. By planning ahead and making informed decisions, individuals can make the most of their mortgages and achieve their homeownership goals.

Conclusion

In conclusion, mortgages are an essential component of the real estate market, providing individuals with the opportunity to purchase homes through long-term financing. They offer numerous benefits, including building equity and tax savings, and can be a smart financial decision for those who plan ahead and budget appropriately. However, they also carry risks, including the possibility of foreclosure and damage to credit scores. To make the most of a mortgage, individuals must carefully consider their financial situations and goals, research their options, and plan ahead for the future.